School districts already faced budget shortfalls before the coronavirus pandemic hit.

The pandemic added significant new expenses and reductions in tax revenue. In doing so, it created a dire situation for schools and state and local governments. To address this situation, the federal government passed the CARES Act. The CARES Act provides emergency relief to individuals, schools, and small businesses.

Read on to learn more about K-12 emergency relief funds and how your school can use them.

The Impact of the Coronavirus Pandemic on K-12 Schools

Beginning in March 2020, many U.S. schools closed their buildings and shifted to online learning. Most schools remained shuttered through the end of the school year. These changes upended the way most teachers taught and students learned.

In a matter of days, teachers adapted in-person lessons to online instruction. Students, teachers, and parents learned to navigate new online learning platforms. Meanwhile, administrators struggled with the impact these changes had on school budgets.

As fall approached, schools continued to adapt to the challenges of the pandemic. Individual schools and districts took different approaches to these challenges.

Some schools chose to continue fully remote learning. Others chose a hybrid model. Still, others returned fully to in-person learning while implementing health and safety protocols. Each of these options required additional expenses and training.

Added Expenses

Depending on the format with which they’ve chosen to begin the year, schools face many added expenses. These include but are not limited to:

- Personal protective equipment (PPE), including masks, face shields, and gloves

- Cleaning supplies, including disinfectants, wipes, hand sanitizer, soap, and paper products

- Healthcare equipment, including thermometers

- More staff, including full-time teachers and substitute teachers

- Newly adopted or upgraded online learning platforms and tools

- More bandwidth to improve Wi-Fi at school

- Mobile hotspots for students lacking access at home

- Audio-visual equipment for recording and streaming live lessons

- New or upgraded devices, including laptops and Chromebooks, for students and staff

Decreased Revenue

As schools grapple with these expenses, they also face budget shortfalls. Normally, schools receive the majority of their funding from state and local sources.

In the 2016-17 school year, schools received 47% of their funding from state sources. They received 45% from local sources. The federal government supplied the remaining 8%.

Unfortunately, the coronavirus not only increased the need for this money. In many ways, it also decreased available funds.

State and local funding for K-12 schools comes from income and sales tax revenue. When the pandemic shuttered schools, it also shuttered businesses. This shutdown reduced consumer spending. It also led to a significant increase in unemployment. Together, these factors caused tax revenue to plummet.

During the pandemic, monthly unemployment rates neared 15%. These rates exceeded unemployment rates during the Great Recession.

Facing their own budget shortfalls, many governors announced cuts in school funding. Unfortunately, these cuts came precisely as school districts need financial help the most.

These cuts also disproportionately hit economically disadvantaged schools. The majority of school funding comes in about equal parts from state and local resources. Local school funding derives primarily from property taxes. Property tax revenue is significantly lower in economically disadvantaged areas.

Under normal circumstances, states attempt to lessen this disparity. Yet the pandemic has limited their ability to do so. As a result, the coronavirus pandemic has widened educational inequities.

What Is the CARES Act?

Recognizing the seriousness of the situation, the federal government stepped in.

On March 27, 2020, President Trump signed the bipartisan CARES Act. The CARES Act provides $2 trillion in relief funds. These funds target individuals, businesses, and schools. This package included the $30.75 billion Education Stabilization Fund.

In fact, the CARES Act established four grant programs for educational institutions. These include:

- Education Stabilization Fund Discretionary Grants

- Governor’s Emergency Education Relief (GEER) Fund

- Elementary and Secondary School Emergency Relief (ESSER) Fund

- Higher Education Emergency Relief (HEER) Fund

The Higher Education Emergency Relief Fund targets post-secondary institutions. Meanwhile, the other three programs provide significant help to K-12 schools.

ESSER and GEER Funds

Of the most immediate interest to K-12 educators were the ESSER and GEER funds. ESSER funds allocated $13.2 billion to K-12 schools. According to the Brookings Institute, ESSER funds equate to approximately $270 per student. GEER funds provided $3 billion.

The difference between these two funds is in how they are distributed. ESSER funds target K-12 education. State educational agencies are responsible for allocating them to local schools. GEER funds benefit both K-12 and higher education. State governors are responsible for allocating GEER funds.

ESSER Funds

The U.S. DOE awarded ESSER funds to state educational agencies (SEAs). Under the CARES Act, SEAs had until July 1, 2020, to apply for ESSER funds. SEAs then received grants to distribute to local educational agencies (LEAs).

SEAs have discretion in awarding about 10% of these funds. However, the CARES Act requires that states distribute 90% of ESSER funding according to the Title I, Part A formula. This formula benefits schools with a disproportionate number of low-income families.

An Interim Final Rule (IFR) from the DOE aimed to send additional funding to private schools. On September 4, however, the U.S. District Court struck down this rule. Education Secretary DeVos announced that she will not appeal. Moving forward, the Title I, Part A formula applies.

Individual states established procedures and deadlines for LEAs to apply for funding. Funds not allocated to LEAs within one year must be returned to the DOE.

GEER Funds

The U.S. Department of Education awarded GEER funds directly to the office of state governors. All states completed applications and received grants.

The DOE based the amount of funding on a formula that considered two factors:

- A state’s school-age population

- A state’s poverty rates

Governors are responsible for distributing GEER funds to LEAs. Individual governors’ offices established procedures and deadlines for LEAs to apply for funding. States must return any funds they fail to distribute within one year of the award.

Also like ESSER funds, GEER funds fell under the DOE’s IFR, which the U.S. District Court overturned. Thus, private schools face limitations in seeking ESSER and GEER funding.

Education Stabilization Discretionary Grants

The DOE also reserved 1% of its CARES funding for special grant programs. These include Rethink K12 Education Models grants.

The DOE will award these grants to states facing the greatest impact from the pandemic. These grants aim to promote innovation in the delivery of high-quality remote education.

As with ESSER funds, SEAs must apply for Rethink K12 Education Models grants. Proposed projects must achieve at least one of the following goals:

- Provide microgrants to help parents meet the needs of children learning remotely

- Develop or expand statewide virtual schooling

- Otherwise, address the specific education needs of the state’s students during remote learning

How Can I Use CARES Act Emergency Relief Funding for My School?

To receive ESSER or GEER funding, LEAs must apply to the relevant state agencies. Individual states established policies and deadlines according to federal guidelines. The National Conference of State Legislatures has compiled a list of these policies. Its tracking tool offers help to local administrators as they navigate this process.

LEAs must use CARES funding to provide emergency education services during the pandemic. LEAs are limited to using these funds to cover expenses they incurred on or after March 13, 2020. This date coincides with President Trump’s declaration of a national emergency.

SEAs and LEAs have until September 30, 2022, to obligate these funds. “Obligating” funds is different from “awarding” funds. Obligating funds means that the LEA has committed the funds to a specific purpose.

Obligating Funds Under the CARES Act

Funding from the CARES Act for K-12 schools can cover a variety of purposes. This includes any purpose allowable under the following federal education and poverty laws:

- The Elementary and Secondary Education Act of 1965 (ESEA)

- Amendments to the ESEA under the Every Student Succeeds Act of 2000 (ESSA)

- The Individuals with Disabilities Education Act (IDEA)

- The Adult Education and Family Literacy Act

- The Perkins Career and Technical Education (CTE) Act

- The McKinney-Vento Homeless Assistance Act

Using the CARES Act to Meet the Needs of Disadvantaged Students

Allowable expenses under the CARES Act focus on efforts to help disadvantaged students. These include:

- Children from low-income families and/or children who are homeless

- Children with disabilities who are receiving special education services under IDEA

- English language learners and/or migrant children

- Children who are members of racial and ethnic minority groups

- Children in foster care

Allowable Purposes Under the CARES Act

As they work to meet these and all students’ needs, schools can obligate CARES Act funds for any of the following purposes:

- Coordinating public health efforts with local, county, state, and federal health agencies

- Offering professional development and other resources to principals and local school administrators

- Planning for extended closures and ensuring continued high-quality remote learning

- Purchasing hardware, including computers, laptops, audiovisual equipment, and routers, to facilitate remote learning

- Increasing bandwidth to improve Wi-Fi in school buildings

- Purchasing and installing mobile hotspots for families who lack internet access at home

- Purchasing software, including online learning platforms and behavior management tools, for use in the physical and/or remote classrooms

- Purchasing assistive and adaptive technology

- Training teachers to use new hardware and software

- Providing special education services

- Providing teachers with professional development on remote learning

- Providing teachers with professional development on sanitation and disease control procedures

- The purchase of sanitation supplies for school buildings

- Efforts to support the mental health of students, staff, and families

- Providing meals to students

- Providing summer and/or after-school programs

Importantly, this extensive list is not exhaustive. The CARES Act also allows principals of individual schools some discretion in obligating funds.

Education experts advise school administrators to take a proactive approach to these efforts. This means anticipating—as much as possible—students’ educational needs during the pandemic. It means, further, investigating resources available to meet these needs.

Behavior Management Needs in the Remote Classroom

Even before the pandemic, behavior management was among the most pressing needs of K-12 educators. Teachers themselves speak to the need for more behavior management resources and training.

Before the pandemic, almost half of all teachers expressed concern that they were unequipped to manage behavior in their classrooms. The rise of remote learning and additional pandemic-related stresses heighten this concern.

Under normal circumstances, teachers can struggle to keep students’ attention. Under normal circumstances, teachers also work to promote social-emotional learning. Finally, under normal circumstances, teachers work with students who are struggling with various personal and family issues.

Each of these efforts has become more important during the pandemic. They have also become more difficult. As educators, parents, and students navigate these circumstances, they need resources and support. Behavior management plans—and software applications that develop them—can provide this support.

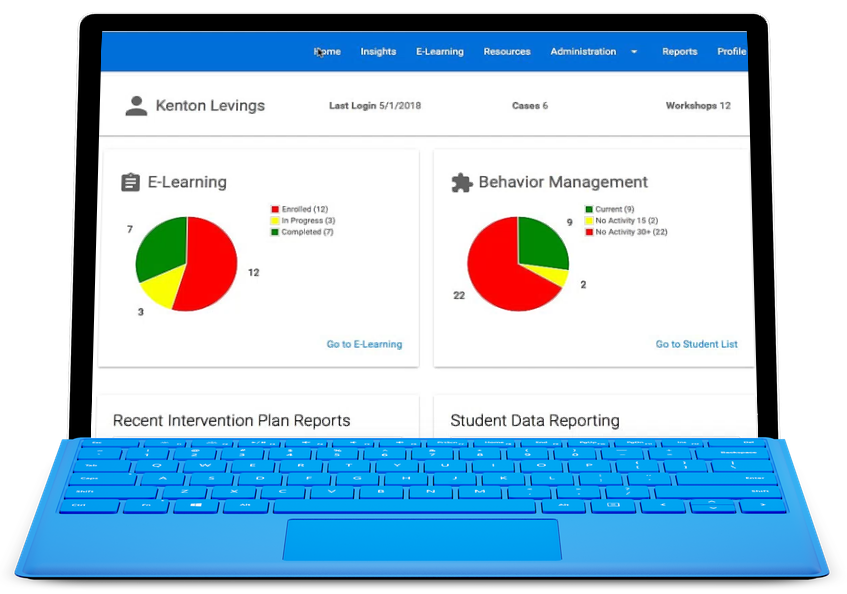

Programs like Insights to Behavior make the observations, record-keeping, and analysis of behavior management more efficient. With Insights to Behavior software, educators can create legally-defensible behavior intervention plans in under an hour.

Fortunately, the CARES Act provides funding for precisely these kinds of programs. Directors of special education can learn more about Insights to Behavior software by scheduling a 30-minute online demo.

Other members of the educational team can supplement these efforts with their own professional development. Once again, Insights to Behavior can help. School counselors, special education directors, school psychologists, and behavior interventionists can sign up for a free monthly webinar series on managing student behavior series.

Together, these efforts can promote academic, social, and emotional learning. They can do so, moreover, in the regular physical and remote classrooms.

Teaching During the Pandemic: Showing Students That Someone CARES

The coronavirus has altered life as we knew it. For children, educators, and parents, the school was and is a big part of that life.

The pandemic changed the way schools deliver services. It increased education-related stresses and expenses. It also led to cuts in school funding.

The CARES Act addresses the resulting budget shortfalls. In doing so, it helps schools maintain high-quality education under emergency circumstances.

A high-quality education develops the whole child—academically, socially, and emotionally. As you explore ways to meet the needs of children in your care, count on the experts at Insights to Behavior to help.